are funeral expenses tax deductible in california

In other words if you die and your heirs pay for the funeral themselves they will not be able to claim any deductions for those expenses on their taxes. Individual taxpayers cannot deduct funeral expenses on their tax return.

Tax Tip Can I Claim Nursing Home Expenses As A Medical Expense 2022 Turbotax Canada Tips

However funeral expenses can qualify as tax deductions when the costs are paid out of a decedents estate.

. While funeral costs paid by friends family or even paid from the deceased individuals account are not deductible from your annual taxes the estate of your loved one can take a deduction on these costs. You cant take the deductions. The Canada Revenue Agency CRA has designated that funds held in a prepaid funeral account called an Eligible Funeral Arrangement EFA must be guaranteed to 10000000 and earns tax exempt interest.

Furthermore the IRS typically qualifies tax deductions on medical expenses. In other words funeral expenses are tax deductible if they are covered by an estate. Job Expenses and Certain Miscellaneous Itemized Deductions.

The primary rule for claiming funeral expenses as a tax deduction is that the costs must be paid out of a decedents estate. Unfortunately funeral expenses are not tax-deductible for individual taxpayers. The state gets to collect sales tax on such personal property.

The short answer to this is no -- funeral expenses are not tax-deductible in the vast majority of cases. If your loved one incurred fees from the hospital use of medical equipment lab services prescriptions medical supplies or routine exams you must itemize your tax return. So a 25 souvenir death DVD would no longer cost 25 but 2706.

These are considered to be personal expenses of the family members and attendees and funeral expenses are not deductible on. Per the IRS Miscellaneous Deductions guide Burial or funeral expenses including the cost of a cemetery lot are nondeductible. Deductible medical expenses may include but are not limited to the following.

Qualified medical expenses must be used to prevent or treat a medical illness or condition. The costs of funeral expenses including embalming cremation casket hearse limousines and floral costs are deductible. The 1040 tax form is the individual income tax form and funeral costs do not qualify as an individual deduction.

Deduction CA allowable amount Federal allowable amount. The cost of a funeral and burial can be deducted on a Form 1041 which is the final income tax return filed for. Expenses that exceed 75 of your federal AGI.

They are never deductible if they are paid by an individual taxpayer. Any individual even the ones who personally paid out-of-pocket will not be able to claim funeral expenses on his or her taxes. If the estates funds are used to pay the costs of the funeral those costs can be deducted on the estate.

Funeral expenses that are NOT tax-deductible are any which are not paid by the deceased persons estate. This cost is only tax-deductible when paid for by an estate. The estate itself must also be large enough to accrue tax liability in order to claim the deduction.

Can funeral expenses be deducted Funeral expenses - If you paid for funeral expenses during the tax year you may wonder whether you can deduct these costs on your federal income tax return. The IRS deducts qualified medical expenses. As such individuals cannot claim funeral expenses on their income tax returns and funeral expenses cannot be itemized or deducted on the decedents final tax return.

The funeral establishment may require you to pay this fee in addition to the specific funeral goods and services you select. On home purchases up to 750000. The taxes are not deductible as an individual only as an estate.

All deductions credits and expenses Review all deductions credits and expenses you may claim when completing your tax return to reduce your tax owed Report a. 4 Tips About Funeral Expenses and Tax Deductions The following is an overview of the tax deduction rules for funeral expenses applicable to estates. But this isnt applicable to every estate.

If the deceaseds state is taxable then executors are able to recoup some. No never can funeral expenses be claimed on taxes as a deduction. Funeral expenses are not tax deductible because they are not qualified medical expenses.

According to IRS regulations most individuals will not qualify to claim a deduction for these expenses unless they paid for the funeral out of the funds of an estate. One such deductible expense may be the expenses associated with the cost of the funeral. These are personal expenses and cannot be deducted.

Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person. Funeral Costs Paid by the Estate Are Tax Deductible. This is only applicable to estates that pay taxes and in order for an estate to be required to pay taxes it must have a minimum gross value of 1158 million.

Qualified medical expenses include. While the IRS allows deductions for medical expenses funeral costs are not included. Expenses that exceed 75 of your federal AGI.

On home purchases up to 1000000. Estates however are able to deduct funeral costs from taxes. The funds held in the EFA continue to earn tax exempt interest throughout the life of the funeral beneficiary.

Not all estates are large enough to qualify to be taxed. Medical and dental expenses. Submitting the obituary and unallocated overhead which includes taxes insurance advertising and other business expenses.

Can I deduct funeral expenses probate fees or fees to administer the estate. This means that you cannot deduct the cost of a funeral from your individual tax returns. In short these expenses are not eligible to be claimed on a 1040 tax form.

In order for funeral expenses to be deductible you would need to have paid for the funeral expenses from the estates funds that you are in charge of settling.

Fema Will Provide More Money For Covid Funeral Expenses The New York Times

Understanding Tax Deductions For Charitable Donations

Top Organizations That Help With Funeral Expenses

Can You Claim Funeral Or Burial Expenses As A Tax Deduction For 2019 Cake Blog

Reimbursement Of Funeral Expenses From Estate Ez Probate

Dying With Debt Can Prove Costly For The Survivors

How To Settle An Estate Pay Final Bills Dues Taxes And Expenses Everplans

Does Life Insurance Pay For Funeral Expenses Preplan Funeral

/MedicalExpenseDeductions-46840a26340a4803837a61ea5a199c84.jpg)

20 Medical Expenses You Didn T Know You Could Deduct

18 Medical Expenses You Can Deduct From Your Taxes Gobankingrates

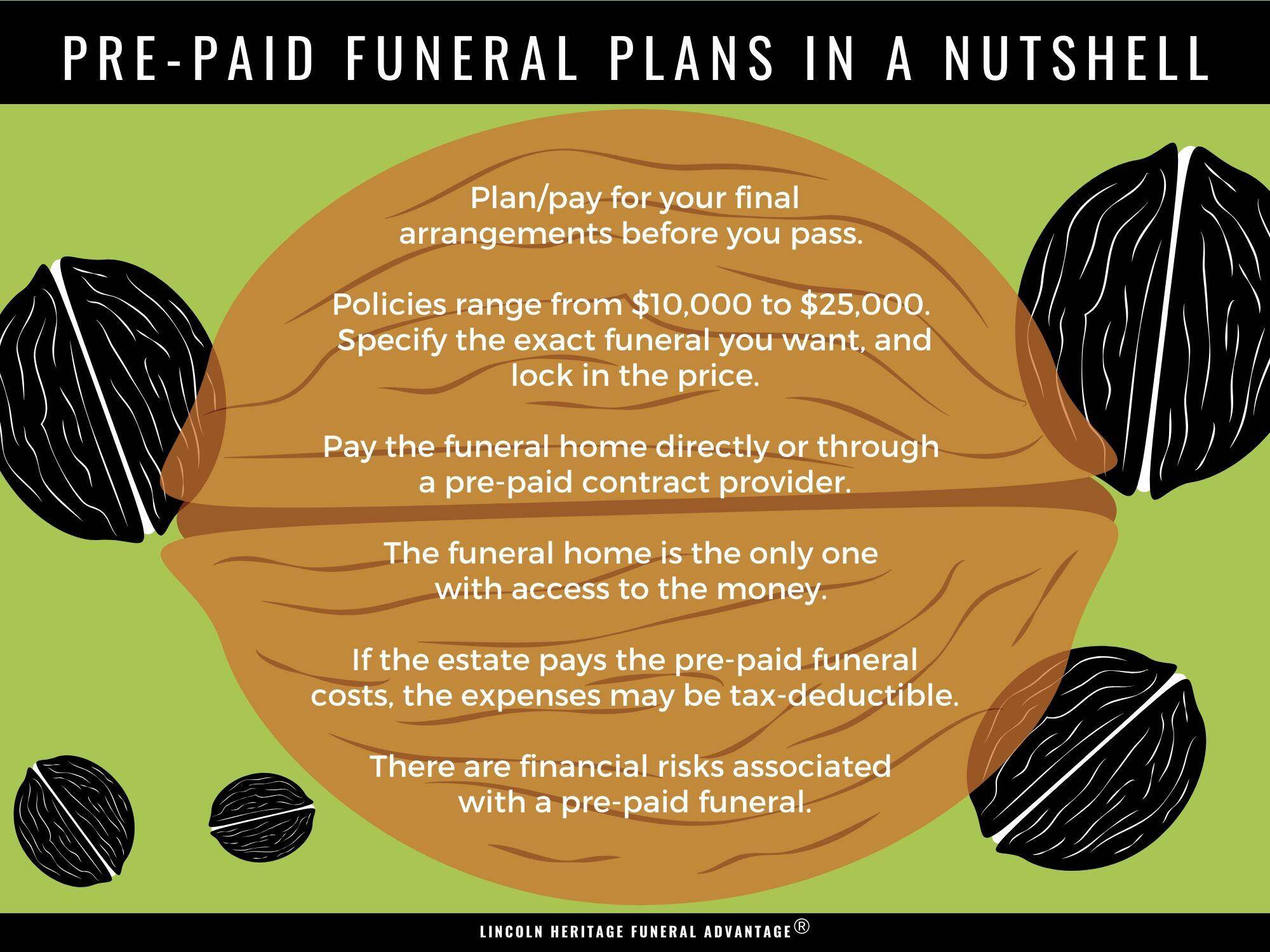

How Prepaid Funeral Plans Work Costs Expenses Pros Cons

Funeral Costs And Cremation Cost What No One Is Talking About Final Expense Direct Best Burial Insurance Rates Companies 2021

Tax Deductions For Funeral Expenses Turbotax Tax Tips Videos

How The Cares Act Sweetened Tax Breaks For Cash Donations In 2020