2022 tax return calculator canada

This personal tax calculator does not constitute legal accounting or other professional advice. Use our free 2022 Ontario income tax calculator to see how much you will pay in taxes.

What Is A 1120 Tax Form Facts And Filing Tips For Small Businesses

Use our simple 2021 income tax calculator for an idea of what your return will look like this year.

. If you are looking to compare salaries in different provinces or for different salary. Average tax rate taxes payable divided by actual not taxable income. 2022 Personal tax calculator Calculate your combined federal and provincial tax bill in each province and territory.

The best free onl. Taking advantage of deductions. 2022 Ontario Income Tax Calculator.

Stop by an office to drop off your documents with a Tax Expert. If you filed your 2020 return and qualified for interest relief you have until April 30 2022 to pay any outstanding income tax debt for the 2020 tax year to. We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. Canada Tax Calculator 202223. Calculate the tax savings your RRSP contribution generates in each province and territory.

The day after you overpaid your taxes. Our online Annual tax calculator will automatically. Here is a list of credits based on the province you live in.

Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax outcome. Estimated balance owing. After-tax income is your total income net of federal tax provincial tax and payroll tax.

40000 x 15 20000 x 15 6000 3000 3000 in net federal tax. 2022 indexation brackets rates have not yet been confirmed to CRA data. 2021 Tax Calculator.

You can also explore Canadian federal tax brackets provincial tax brackets and Canadas federal and provincial tax rates. Reflects known rates as of January 15 2022. Find out your federal taxes provincial taxes and your 2021 income tax refund.

This is any monetary amount you receive as salary wages commissions bonuses tips gratuities and honoraria payments given for professional services This amount is either 18 of your earned income in the previous year or the. The Canada Tax Calculator provides State and Province Tax Return Calculations based on the 20222023 federal and state Tax Tables. The calculator reflects known rates as of January 15 2022.

For more information see Prescribed interest rates. Or you can choose tax calculator for particular province or territory depending on your residence. Select your province Employment income Self-employment income Other income CRB EI CPPOAS Capital gains Eligible dividends Ineligible dividends RRSP contribution Income taxes paid.

British Columbia tax calculator. This calculator is intended to be used for planning purposes. Below there is simple income tax calculator for every Canadian province and territory.

2022 RRSP savings calculator. For example if your non-refundable credits total 20000 and your taxable income is 40000 you are in the first tax bracket. This handy tool allows you to instantly find out how much Canadian tax back you are owed.

2021 2022 tax brackets and most tax credits have been verified to Canada Revenue Agency and provincial factors. Quickly find all the forms deductions and credits you need to file easily all by searching simple keywords. The simple way to declare crypto.

Meet with a Tax Expert to discuss and file your return in person. These calculations are approximate and include the following non-refundable tax credits. Calculations are based on rates known as of May 7 2022 including federal and provincialterritorial tax changes known at this time.

It includes very few tax credits. Please enter your income deductions gains dividends and taxes paid to get a summary of your results. The Canadian tax calculator is free to use and there is absolutely no obligation.

Start with a free eFile account and file federal and state taxes online by April 18 2022. We strive for accuracy but cannot guarantee it. 8 rows Canada income tax calculator.

Assumes RRSP contribution amount is fully deductible. Use the Canada Tax Calculator by entering your salary or select advanced to produce a more detailed salary calculation. The Canada Annual Tax Calculator is updated for the 202223 tax year.

This marginal tax rate means that your immediate additional income will be taxed at this rate. The basic personal tax amount CPPQPP QPIP and EI premiums and the Canada employment amount. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here.

ICalculator aims to make calculating your Federal and State taxes and Medicare as simple as possible. The CRA will pay you compound daily interest on your tax refund for 2021. You can calculate your Annual take home pay based of your Annual gross income and the tax allowances tax credits and tax brackets as defined in the 2022 Tax Tables.

This means that you are taxed at 205 from your income above 49020 80000 - 49020. Your average tax rate is 220 and your marginal tax rate is 353. Most people want to find out if its worth applying for a tax refund before they proceed.

Since April 30 2022 falls on a Saturday in both of the above situations your payment will be considered paid on time if we receive it or it is processed at a Canadian financial institution on or before May 2 2022. 2022 CWB amounts are based on 2021 amounts indexed for inflation. You simply put in your details get.

Have a refund of 2 or less. In Canada each province and territory has its own provincial income tax rates besides federal tax rates. That means that your net pay will be 40568 per year or 3381 per month.

File your taxes the way you want. To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4. Calculations are based on rates known as of March 16 2022.

There are a variety of other ways you can lower your tax liability such as. Seamlessly import your income tax slips and investment info from CRA Revenu Québec and Wealthsimple accounts to speedily complete your 2021 return. For example in the 2021 tax season if you earn 80000 you will be in the 49020 to 98040 tax bracket with a tax rate of 205.

Shows combined federal and provincial or territorial income tax and rates current to. Use the simple annual Canada tax calculator or switch to the advanced Canada annual tax. The Canada Tax Calculator by iCalculator is designed to allow detailed salary and income tax calculations for each province in Canada.

Youll get a rough estimate of how much youll get back or what youll owe. This calculator is for 2022 Tax Returns due in 2023. Interest on your refund.

The calculation will start on the latest of the following three dates. The 31st day after you file your return. The best starting point is to use the Canadian tax refund calculator below.

Annual Tax Calculator 2022.

:max_bytes(150000):strip_icc()/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)

Form 1040 U S Individual Tax Return Definition

Schedule C Form 1040 Irs Taxes Accounting And Finance Schedule

How To Fill Out A Fafsa Without A Tax Return H R Block

When Is It Safe To Recycle Old Tax Records And Tax Returns

2022 Tax Day Filing For A Tax Extension Here S How That Works And When Your Taxes Are Due Nbc Chicago

How To File A Zero Income Tax Return 11 Steps With Pictures

Tax Day Is Coming Soon Here S What You Need To Know About Filing Your 2021 Taxes Chicago News Wttw

How To File A Zero Income Tax Return 11 Steps With Pictures

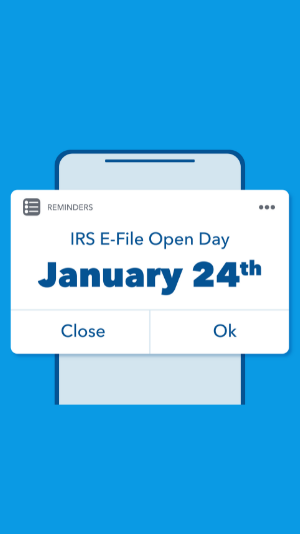

Tax Filing Season 2022 What To Do Before January 24 Marca

How To File Your Uk Taxes When You Live Abroad Expatica

2019 Canadian Tax Tips My Road To Wealth And Freedom Canadian Money Tax Refund Finances Money

Tax Debt Help Bear De 19701 Tax Debt Debt Help Payroll Taxes

My Tax Return Is So Low This Year When It S Been Generally Bigger Other Years And I Can T Figure Out Why I Worked Full Time All Year I Ve Looked Over My 1040

Avoid 6 Mistakes That Will Delay Your Irs Tax Refund

Loan Flat Icons Set In 2022 Flat Icons Set Flat Icon Icon Set

How To Deduct Stock Losses From Your Taxes Bankrate

How To Get Your Maximum Tax Refund Credit Com

Irs Announces E File Open Day Be The First In Line For Your Tax Refund The Turbotax Blog